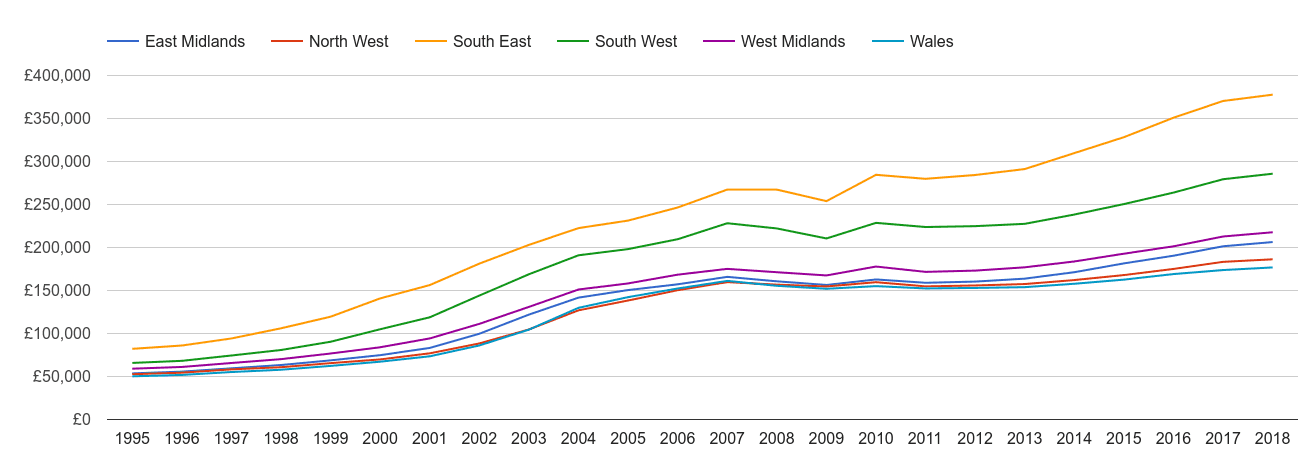

The Midlands is a ‘bright spot’ for the property market it has risen by 6.1% outperforming all of the other parts of the country according to the Office for National Statistics.

In the past there has been a distinct divide between the north and south due to the financial crisis in the UK property market. This meant houses were raising sharply in the south but gains were insignificant in the midlands and the north.

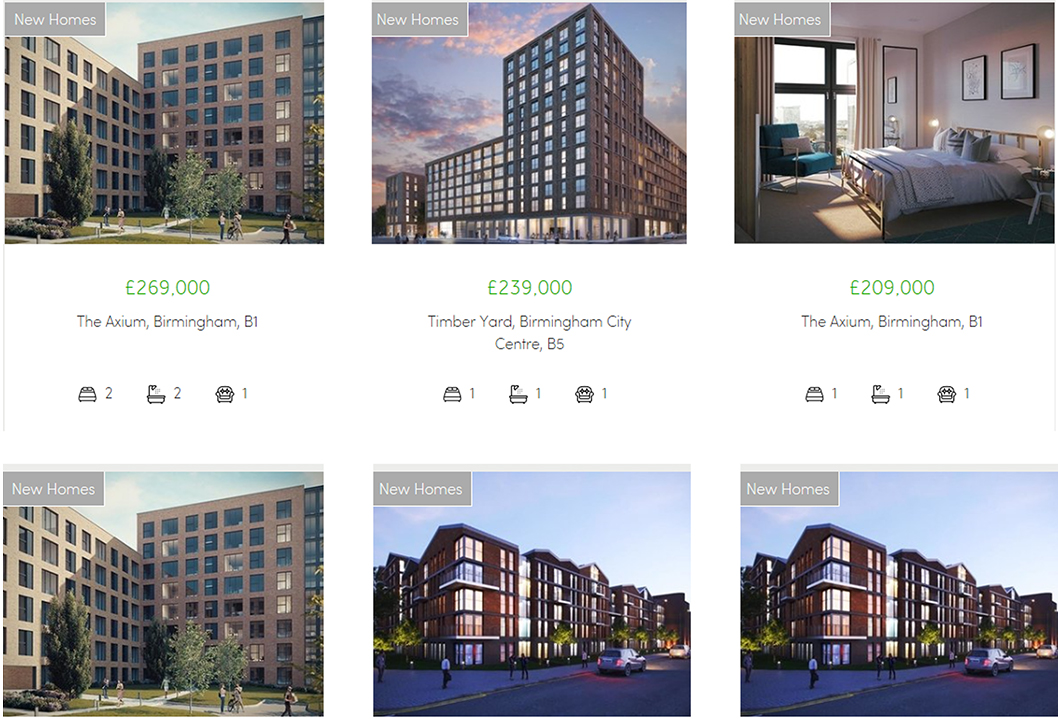

Here and now that has completely inverted as London and the home counties are suffering. The property market in London is decreasing as prices have reduced by 0.3 per cent in London. The new property hotspots are the northern cities such as Manchester, Liverpool and Leeds this also include the West and East Midlands. The property price explosion in London and the Home Counties in recent years seems finally to be rippling out to other parts of the country. This is resulting in new build property prices across the county to increase to an average of £286,985 and existing properties to be £221,850.

This conclude that despite the uncertainty Brexit has caused the property market is still robust. As the slowdown in the market is starting to fade we advise this is time to take full advantage of the upcoming areas as they growing such as Birmingham.